IN Form 5196 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

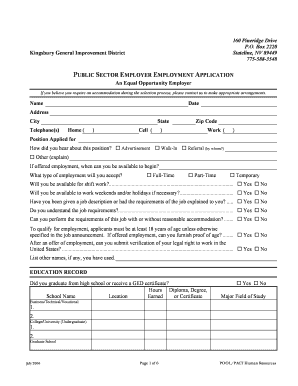

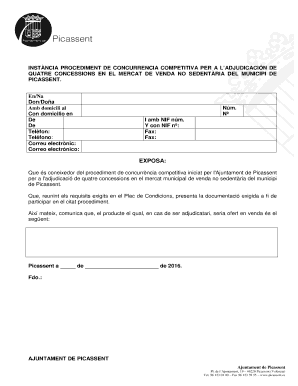

Understanding the IN Form 5196 Printable Form

What is the IN Form 5196 Printable Form?

The IN Form 5196 is a specific document often utilized in business transactions to provide essential information relevant to tax filings or compliance requirements. It serves as an official means to report certain financial details, ensuring that all necessary disclosures are made to the appropriate authorities.

Key Features of the IN Form 5196 Printable Form

The IN Form 5196 includes several key features, making it a vital tool for users. These features encompass clear sections for entering personal or business identification details, financial information, and specific statements required by tax regulations.

When to Use the IN Form 5196 Printable Form

This form is typically used in situations where financial disclosures are necessary for compliance with IRS requirements. It becomes essential when submitting tax-related documents or when there are changes in financial circumstances that need official reporting.

How to Fill the IN Form 5196 Printable Form

Filling out the IN Form 5196 requires attention to detail. Begin by entering your identification information accurately, followed by the financial details outlined in the form. Ensure all sections are completed thoroughly to avoid any potential errors or omissions.

Common Errors and Troubleshooting

Common mistakes while filling out the IN Form 5196 include inaccuracies in identification numbers or incomplete financial disclosures. It is important to double-check all entries and ensure that all required fields are filled out to minimize issues during submission.

Benefits of Using the IN Form 5196 Printable Form

Utilizing the IN Form 5196 brings several advantages, such as ensuring compliance with tax regulations, facilitating accurate financial reporting, and providing a clear structure for documenting essential information. This form can also help streamline the process of submitting necessary documentation to the IRS.

Frequently Asked Questions about lic loan form pdf

Who needs to fill out the IN Form 5196?

Individuals or businesses required to disclose financial information to the IRS should complete the IN Form 5196. This typically includes self-employed individuals, business owners, and taxpayers with specific financial obligations.

pdfFiller scores top ratings on review platforms